High inflation and how to protect against it

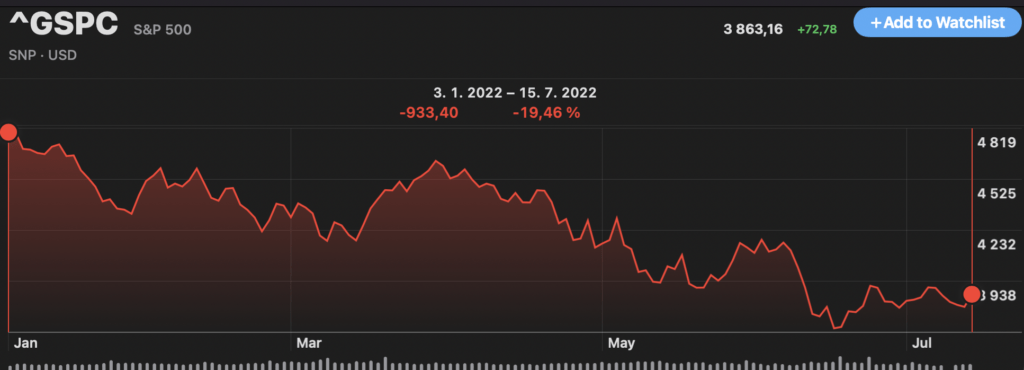

It was probably impossible not to notice that inflation in the Czech Republic has been rising steadily for many months and is starting to reach record numbers. What has become unimaginable for many in the context of cheap money and low inflation over the last twenty years is back. Inflation is rising persistently and the world economy is turning into a recession.

There are many reasons why this has happened, but we will give the two most important ones. It became quite clear that inflation was going to rise the moment that, as a result of the pandemic, an absolutely unprecedented amount of money began to be issued and pumped into the system. Although the effect was not immediate, it was bound to occur over the longer term. Another significant factor is the ongoing war in Ukraine. The gradual reduction in the supply of oil and gas to Europe has accelerated the energy crisis already under way, and commodity prices have skyrocketed.

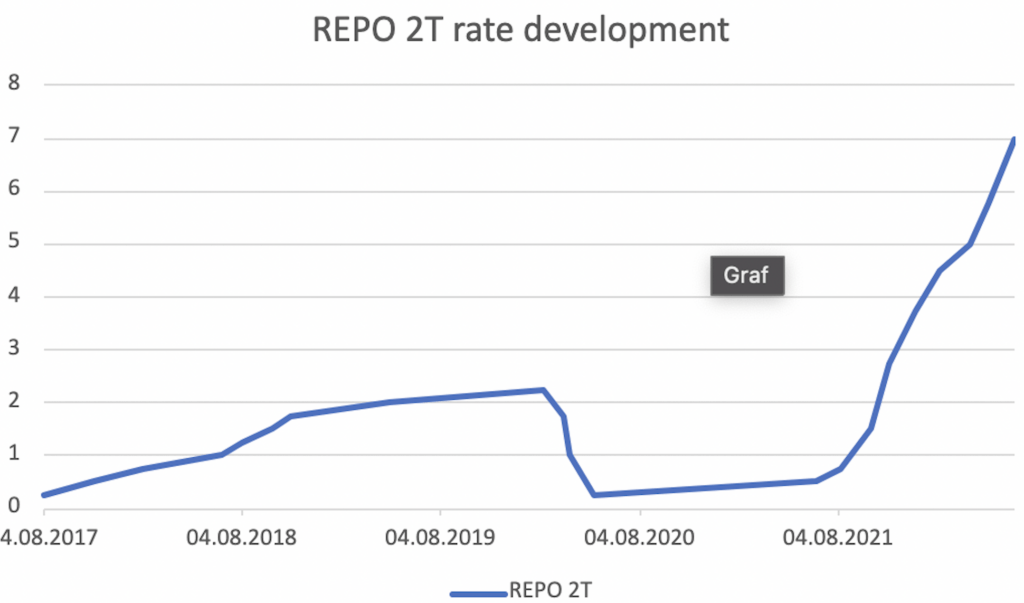

The rising inflation must be addressed by an institution specifically set up for this purpose – the Czech Central Bank. It started in 2021 with a gradual increase in interest rates to the current REPO2T of 7%. At the same time, foreign exchange interventions are taking place to strengthen the Czech currency

The resulting situation affects all market players to varying degrees.

Companies: these are challenging times for businesses. Disrupted supply chains and dramatic increases in input commodity prices are resulting in a sharp rise in input costs. In parallel, it is becoming significantly more costly for companies to service their own debt as higher interest rates are gradually being reflected in repayments. In principle, it is not possible for a company’s costs to be higher than its revenues in the long term. In order to survive, a company must start to increase the price of its output products.

Citizens: everyone will feel the price increases to a greater or lesser extent. The first to be reflected in everyday costs are the rising prices of daily necessities and fuel. As electricity and gas prices are phased out, households are moving to new, significantly more expensive tariffs. Rising interest rates will dramatically increase the cost of servicing loans, and high inflation will gradually burn through a substantial portion of savings.

Data summary for June 2022

Consumer prices rose 17.2% year-on-year in June, up 1.2 percentage points from May. Analysts in a Reuters poll had expected a 17% rise. Consumer prices have thus been rising uninterrupted for twelve months. On a month-on-month basis, consumer prices rose by 1.6%, mainly due to higher prices for housing, food and non-alcoholic beverages. This is according to today’s announcement by the Czech Statistical Office.

Of the individual foodstuffs, prices of flour, for example, increased significantly by almost 70 percent. Bread rose by 28.6 per cent, poultry meat by a third, semi-skimmed long-life milk by 42.3 per cent, butter by 55.8 per cent, other edible oils by 58.7 per cent and sugar by 41.3 per cent. Food service prices were up by nearly a quarter. In the housing section, prices of natural gas in particular rose by 57.8 per cent (up from 49.2 per cent in May) and solid fuels by 34.0 per cent. Prices for full-service vacations increased 15.4 percent.

The largest contributors to the year-on-year increase in June were prices in the housing section, where, in addition to the cost of owning a home, apartment rents rose by 4.6 per cent, water charges by 5.3 per cent, sewerage charges by 6.4 per cent, electricity by 31.6 per cent and heat and hot water by 18.1 per cent.

The Czech koruna climbed to its strongest level against the euro since February after the data, with an interim low of 24.2680 per euro before 10:00 CET. The Czech National Bank has raised interest rates by a cumulative 6.75 percentage points over the past year in an effort to tame inflation and prevent inflation expectations from unanchoring. Money markets are pricing in at least another half-point increase for the third quarter, Bloomberg wrote.

How to protect savings against inflation?

Inflation is traditionally the biggest enemy of monetary savings, and it can burn through huge chunks of wealth in a short period of time. Fortunately, there is a way to protect against the effects of inflation, or at least partially mitigate them. The only instrument that can reliably and fully cover inflation without taking the risk of asset value fluctuations are government anti-inflation bonds. This is a product we have widely recommended to our clients – the principle is to hold government bonds whose yield is determined by the annual rate of inflation. However, due to the high burden on the state budget, this product is no longer offered.

Nowadays, our clients often use the option of depositing their money with the central bank. The current interest rate of 7% p.a., although it cannot beat inflation in full, can definitely mitigate its effects. At the same time, this product gives clients the traditional comfort of fast liquidity (the central bank accepts and settles deposits every week) and minimal risk.

If you would appreciate a consultation on how to protect your assets in the current turbulent market environment, please do not hesitate to contact us. We provide our clients with analyses of the market situation as well as banking and investment products and are happy to help with the accompanying legal and language issues. We understand that trust must be earned. That’s why we offer new clients a free first consultation so that you can decide whether the potential cooperation brings you sufficient added value.

-

Previous Post

Types of Residency

-

Next Post

Pre-approved Mortgages

Related Posts

You Do Not Need Permanent Residence (PR) In The Czech Republic To Buy a Property in Prague

You Do Not Need Permanent Residence (PR) In The Czech Republic To Buy a Property…

Early repayment of mortgages will be more complicated starting from September

Early repayment of mortgages will be more complicated starting from September Banks will be able…

How Long Does It Take To Process a Mortgage as an Expat?

How Long Does It Take To Process a Mortgage as an Expat? PREFER PICTURES OVER…

American Mortgage

American Mortgages So called American Mortgage is a special type of mortgage that allows you…